Irrationalities of the Financial Markets

As we have discussed earlier, the number of retail investors in the market has increased significantly over the last years. It has created irrationalities in the market. The examples include:

- Significant inflow into the wrong stocks due to hype. During the early stage of COVID following the initial lockdowns, the investors have been heavily investing in Zoom (ZM)for its video calling and conferencing capabilities, however some investors invested into the wrong ticker – leading to the increase of price in not well-known company that has nothing to do with video conferencing

- Trying to Invest into the company that is not publicly traded. The largest most recent example is an application called Clubhouse . It has offered the audio rooms capability that got a lot of media and social networks attention. This attention led to a significant share price increase in unrelated company with the same name

- Price increases of going through into the bankruptcy companies. COVID has brought a havoc upon the companies that were in the weaker financial health or having hidden problems. Hertz for instance had a significant hit on their business operations and despite being on the brink of bankruptcy, the investors pumped money into it and the stock bounced from its bottom

Idea of Diversification

The examples above highlight the fact that the irrationalities in the market can make your investments perform not as anticipated. The idea of putting all eggs in different baskets is inherently based on pure math and the way the risks are lowered non-linearly, while returns being the average return on the instruments. We will have already introduced the concepts of returns and risks. Now let’s imagine the two different stocks that we can invest in. The table below has their financial risk and return measures for the following year:

| Expected Return | Standard Deviation | |

| Stock A | 9% | 10% |

| Stock B | 7% | 8% |

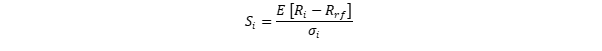

Sharpe Ratio

One of the common measures of the performance for stocks is Sharpe Ratio:

Let’s calculate it for the stocks above with Rrf = 1%:

Sharpe Ratio (A) = (9% – 1%) / 10% = 0.8

Sharpe Ratio (B) = (7% – 1%) / 8% = 0.75

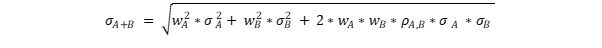

Portfolio Risks and Returns

Let’s see how it would change if we created a portfolio of the two stocks weighted in 50 / 50 proportion. The calculation of the Expected Return will be easy for us, we just need to multiply the returns of each individual portfolio by 0.5 and sum them up:

Expected Return (A+B) = 0.5 * 9% + 0.5 * 7% = 8%

The standard deviation calculation is going to be more complex with many more moving parts attached to it. The equation will take into consideration of each asset’s individual risk as well as the offset of the risk due to diversification:

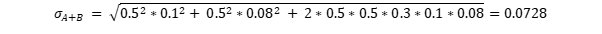

For this example, we will consider correlation equal to 0.3. You can read more about the correlation in the article dedicated to risk.

Let’s see now how our combined portfolio has performed compared to our one-stock positions:

Sharpe Ratio (A+B) = (8% – 1%) / 0.0728 = 0.9615

The combined result shows much better relative risk / reward performance. This is how the diversification can help you to manage your risks and better utilize the risks within your portfolio.

Please note, none of the information on this blog represents the opinion of my employer and all information does not represent a financial advice.

I see, thanks for the finance enlightenment

LikeLike