Market updates

This week’s market updates will focus on the bond markets and yield curves. Overall the equities markets have rebounded displaying the high level of confidence, but the yield curves and hikes tell us an opposite story with the significant headwinds still ahead of us.

Following the 0.75% rate hike to 2.25% – 2.50% level by Fed, we have seen the signs of yield curve inversion. The inversion between 2-year – 10-year (2s/10s) has reached -41bps this Friday. You can check more information in the ‘Yield curve’ article that I have received this week. Based on the GDP data we are already in the recession, just like we had in Q1 2020 due to Covid. The 2s/10s further confirms that recession, however that is sadly not the case with the US government. Additionally, have a look at the graph from Fed website below to better understand the context:

The UK might be lagging behind in terms of the current state of economy with an ongoing cost of living crisis, but it is right on par with US in terms of taking a firm action against the inflation. There was a 50bps rate hike in UK just a week after the Fed’s hike and the rate has increased from 1.25% to 1.75%. It was also announced that the Bank of England’s forecast is that UK will enter a 5-quarters long recession in the 4th quarter of this year.

Focus theme: Taiwan

This week has been full of the geopolitical events with another set of countries coming on the brink of the conflict following up on Serbia-Kosovo tensions last weekend. In a space of roughly 24 hours, we have seen:

- Kosovo announcing additional limitations on the Serbs living in the North part of Kosovo,

- Those Serbs protesting and closing the roads while being threatened by Kosovo police,

- Serbian government mentioning the fact that they could be forced to protect their people (with one of the government officials that Serbia needs to ‘de-nazify’ Kosovo, the line that is becoming too mainstream in Eastern Europe in 2022),

- NATO saying that they are ready to step into the conflict if required, and

- Eventually, Kosovo government stepping back on the new legislation and postponing its implementation.

Quite a lot of events for a 24-hour stint… Though I can say it got us all prepared for another escalation event this week. There were more than 700 thousand people watching the flightradar24 flight of Nancy Pelosi to Taiwan to meet with the Republic of China’s (ROC) officials there. We are still going to see the impact of that as any sane person should question the official line that such act in no way goes against the one China principle that US publicly supports as People’s Republic of China’s (PRC) government does not exactly recognise ROC’s officials as the ones that should participate in such high-level US officials’ visits.

PRC has highlighted that this visit can result in an unprecedented reaction from China that was widely mocked in the internet using the wiki page referring to the Russian saying ‘China’s final warning’. The problem with using this saying is that it refers to the warning that carries no real consequences.

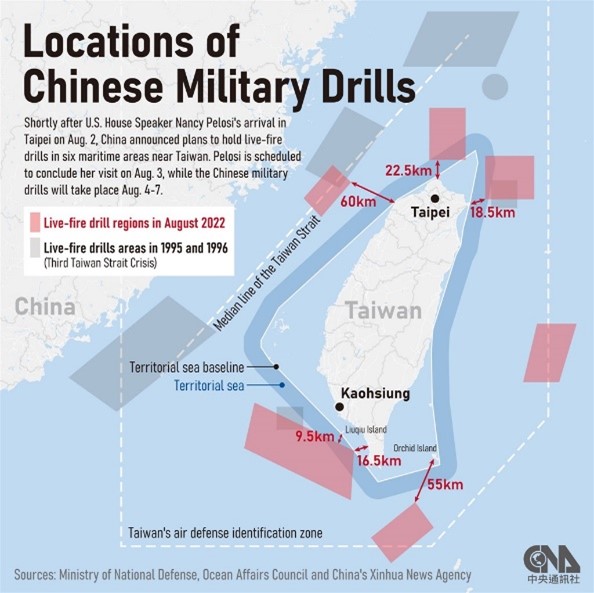

The mockery seems very reckless. Pelosi’s visit has triggered the widescale military drills encircling the island. Some reports say that these drills simulate the widescale attack on the island scenario similar to the Russian invasion of Ukraine earlier this year.

Is that a real consequence enough? – Not sure, we will see the developments over the coming weeks. Were there any real consequences? – Yes.

Taiwan is the most famous for its semi-conductors’ industry that can suffer now and impact the global economy as the result of that. This small country feed the entire world with its processors and semi-conductors that have allowed us to enjoy the technological innovation. This innovation can get very much endangered by not only the open invasion, but a blockade as the follow up to the military drills. The partial blockade has occurred already in addition to severing the communication with US military as the result of Pelosi’s visit. There is a limitation on the subset of ROC-labelled products including fruits and fish being imported to China as well as the ban on exporting the sands to Taiwan, which is the key material in semiconductors productions.

TSMC is the largest chip producer in the world and the financial performance of it is going to be very much dependent on the future actions of China. If the reports of Chinese being able to produce 7nm size chips are true and they can be scaled, we might see the TSMC losing its crown.

Please note, none of the information on this blog represents the opinion of my employer and all information does not represent a financial advice.